R without G

Good news on AI could be bad news for Europe's debt problems

The decades-long slowdown in productivity growth in advanced economies could end, if generative AI fulfills its potential. This might seem like an unqualified positive for the economy. But if the deployment of AI in Europe follows the path of recent information technology adoption, it could create a fiscal nightmare for Europe.

A team of macroeconomists—Adrien Auclert, Hannes Malmberg, Matthew Rognlie, and Ludwig Straub—just presented a beautiful paper at Jackson Hole examining quantitatively the determinants of the most important price in the economy: the long-run real interest rate (r*), which sets the cost of every borrowing or investment decision throughout the economy. While they do not explicitly discuss the impact of their analysis on Europe, their framework reveals a troubling possibility: high global growth due to AI could significantly push up interest rates globally. If Europe lags behind in adoption, it would create a fiscal squeeze that could threaten the sustainability of our debt burdens.

The asset market framework

Think of the long-run real interest rate as the price that clears a global market for assets. On one side is asset supply: government debt, physical capital, and the stock market value of corporate profits. On the other side is asset demand: how much wealth households and investors want to hold.

When demand for assets rises faster than supply, the price of assets rises, and interest rates fall (recall bond prices move in the opposite direction of rates): if savers want to carry a lot of money into the future, they will bid up asset values and will require a lower interest rate to compensate them. Conversely, when supply of assets rises faster than demand, prices fall, and the long-run rates go up. For instance, if governments need to finance a lot of new debt, its price must go down– that is, rates must rise to successfully place it.1

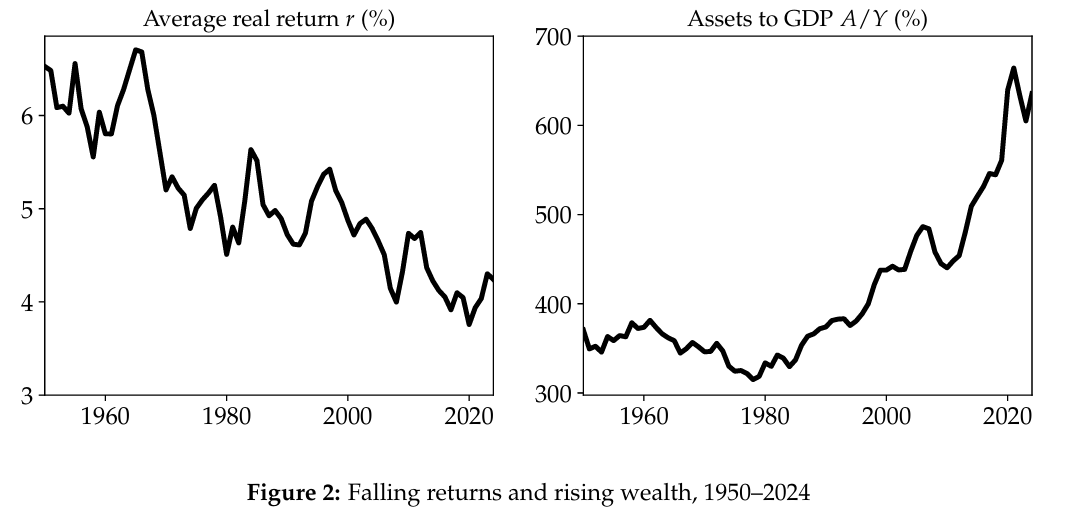

From 1950 to 2024, AMRS show that asset demand decisively “won the race” in the US. Aging populations, rising inequality, and slowing growth all increased the desire to hold assets by 415% of GDP, according to their estimation. Asset supply rose by only 31% of GDP. The result was a secular run-up in asset prices, that is, a large fall in the long-term real interest rate.

Now this may be about to reverse.

How does AI shift asset supply and demand?

The AI revolution, if successful, will lead to higher asset supply. First, AI increases expected future profits, and hence company valuations. Second, AI requires massive investment in data centers and GPUs. Third, more speculatively, it may increase market concentration and corporate markups, further increasing profits. On the demand side, AI will also reduce the demand for assets, since higher productivity growth makes future (younger) workers richer relative to current retirees, and younger cohorts save less than older ones. An increase in supply and a decrease in demand mean lower asset prices, that is, higher rates, reversing the secular trend in r*.2

The magnitudes are significant. According to AMRS calculations, the productivity slowdown since the 1950s was responsible for a decrease in rates of 118 basis points. Hence, if AI were to increase productivity growth as much as it has declined since 1950, it would lead to an increase in rates of 118 basis points.

Note that this increase in r* by itself does not worsen fiscal sustainability, since fiscal sustainability depends on the difference between the rate governments must pay to place their debt, and the growth rate of the economy (that is, r-g). If economies grow faster than the interest rate, the pie is growing faster than the slice going to debt, and the debt burden becomes more sustainable. Indeed, that is the scenario AMRS set out for the US as a result of a positive productivity shock.

But this positive outcome hinges on a crucial assumption: that Europe shares in the AI-driven productivity boom. In globally integrated capital markets, interest rates move together. If AI supercharges the US economy while Europe lags, the continent will face the worst of both worlds: it will import higher interest rates from the rest of the world without the domestic growth needed to service its debt. The crucial “r-g” term that determines debt sustainability would widen dangerously.

The risk of repeating the information technology lag

The goal for Europe is not necessarily to lead in creating foundation models, but to become a 'smart second mover' capable of rapid adoption and adaptation. This is the only way to ensure Europe is ready to profit from AI's productivity growth and offset higher global rates. The alternative—importing higher rates while productivity stays flat—is the surest path to fiscal crisis.

For instance, for France, with 113% debt-to-GDP, a 1% increase in rates would necessitate permanent spending cuts or tax increases of 1% of GDP. For Italy, with 135% debt-to-GDP, the same shock requires 1.3% of GDP in permanent fiscal adjustment.

Worryingly, the risk that Europe will lag in adoption—creating this dangerous “r without g” scenario—is substantial, driven by both our overly cautious regulatory approach and deep-seated institutional rigidities.

The historical experience with the adoption of information and communication technologies (ICT) should serve as a warning. In recent work just presented at the ECB’s 2025 Sintra meeting, Benjamin Schoefer (2025) highlights evidence demonstrating that ICT-intensive industries demand higher rates of worker reallocation and restructuring (Bartelsman et al., 2016). Europe’s institutional rigidity stopped the necessary adjustment. Research suggests that firms in high employment protection environments specialized away from fast-growing, disruptive sectors like ICT to avoid high adjustment costs, favoring instead incremental innovation and leading to sluggish ICT diffusion (Samaniego, 2006; Saint-Paul, 2002). Furthermore, the high “cost of failure” (see our post here) imposed by these rigidities constrains the venture capital investment crucial for scaling innovative tech ventures (Bozkaya and Kerr, 2014).

In sum, Europe's institutional setup appears ill-suited for the rapid transformation demanded by AI. Without addressing these regulatory frictions and, crucially, increasing labor market fluidity, Europe risks repeating its experience with ICT. This inertia underscores the profound danger of the scenario described above: facing the fiscal pressure of higher global interest rates driven by AI growth elsewhere, without reaping the domestic productivity benefits necessary to offset them.

I thank Ludwig Straub and Pierre-Olivier Gourinchas for their comments and conversation.

References

Auclert, Adrien, Hannes Malmberg, Matthew Rognlie, and Ludwig Straub. “The race between asset supply and asset demand”. Jackson Hole Economic Symposium, August 2025.

Bartelsman, Eric, Pieter Gautier, and Joris De Wind. “Employment protection, technology choice, and worker allocation.” International Economic Review 57.3 (2016): 787-826.

Bozkaya, Ant, and William Kerr. “Labor regulations and European venture capital.” Journal of Economics & Management Strategy 23.4 (2014): 776-810.

Saint-Paul, Gilles. “Employment protection, international specialization, and innovation.” European Economic Review 46.2 (2002): 375-395.

Samaniego, Roberto M. “Employment protection and high-tech aversion.” Review of Economic Dynamics 9.2 (2006): 224-241.

Schoefer, Benjamin. “Eurosclerosis at 40: labor market institutions, dynamism, and European competitiveness.” Sintra ECB Forum on Central Banking, July 2025.

Technical note: the whole AMRS analysis is done in rates and not prices. This means that, confusingly, supply slopes “downward” and demand “upward” (in r). I have written this section (unlike in the paper) in asset prices, maybe a bit less precisely, but to try to keep the mental sanity of my readers.

Only one factor would counter these effects: if AI raises inequality (capital share increasing, and superstar pay helping the highest paid) tilting the playing field towards savers and hence increasing asset demand, thereby rising asset prices and lowering rates. This seems to be a second-order effect.

I agree with the second-mover strategy and focusing on the adoption layer, but strategic leverage of some choke points (e.g., ASML's compute supply chain, industrial capacity when robots lag) could still be beneficial. A speculative case for Europe lagging is here, but I am quiet uncertain about the diffusion of AI technology: https://www.forethought.org/research/could-one-country-outgrow-the-rest-of-the-world A superb and more academic paper on r and g with AGI: https://basilhalperin.com/papers/agi_emh.pdf

Great post as always!

If you have not seen, you may be interested in Seth Benzell's quantitative model / Substack post that thinks about how higher rates from AI could spill over across countries: https://empiricrafting.substack.com/p/could-ai-save-us-from-making-hard

And if I may be so bold as to advertise my own work on AI and interest rates...

- https://basilhalperin.com/papers/agi_emh.pdf

- https://basilhalperin.com/essays/agi-vs-emh.html